The Revolutionary Solution

Invoice factoring for the market of the future. Unlock the full potential of the cash tied up in your unpaid invoices with Kyiara.

In a business setting, vendors are issued Purchasing Orders (PO) by companies in need of goods/services. Upon fulfilment of the PO, the vendor generates the associating invoice for rendered service for the Buyer (purchasing company).

The vendor is expected to fulfil a PO as soon as the buyer accepts the invoice. However, such buying companies possess policies that enable them to make payment after a specified time frame of an average of 15 – 45 days, after the invoice has been issued. Vendors in need of funding, are able to sell these invoices as short-term notes with invoice factoring to Financiers.

Small businesses wait an average of 40 days to get paid by clients, these long wait times stunt business growth, tying down much-needed funds to already executed projects.

As a factoring platform, Kyiara connects you to investors who buy your invoice and will pay it out to you within 48 hours. This means your debtor will receive invoices made by you, on your business stationery, carrying your business logo.

Read more

The key players in the invoicing ecosystem and some of the roles they play.

Raises Purchase orders indicating needs of good and services from sellers. Vets filled POs from vendors and makes selection.

Fills Purchase order as required by Buyers. Generates and sends invoices to Buyers. Provides goods/services to Buyers.

Negotiates and purchases unpaid invoices from Vendors. Funds an unpaid invoice for Vendors. Collects payment from Buyer.

Review transactions flowing in the ecosystem. Provides policies that protect all payers enabling a level playing field for all.

Here are some facts we’ve been able to gather about the invoicing and factoring industry

Total turnover for the factoring and commercial finance industry across the EU in 2018.

Financing gap per annum created by unavailability of credit for SMEs in Nigeria.

Global factoring estimate with a growth rate of 6.49%

When factoring was used as a fact of business.

Fraction of factoring industry turnover of EU GDP in 2018

SME’s contribution to global GDP

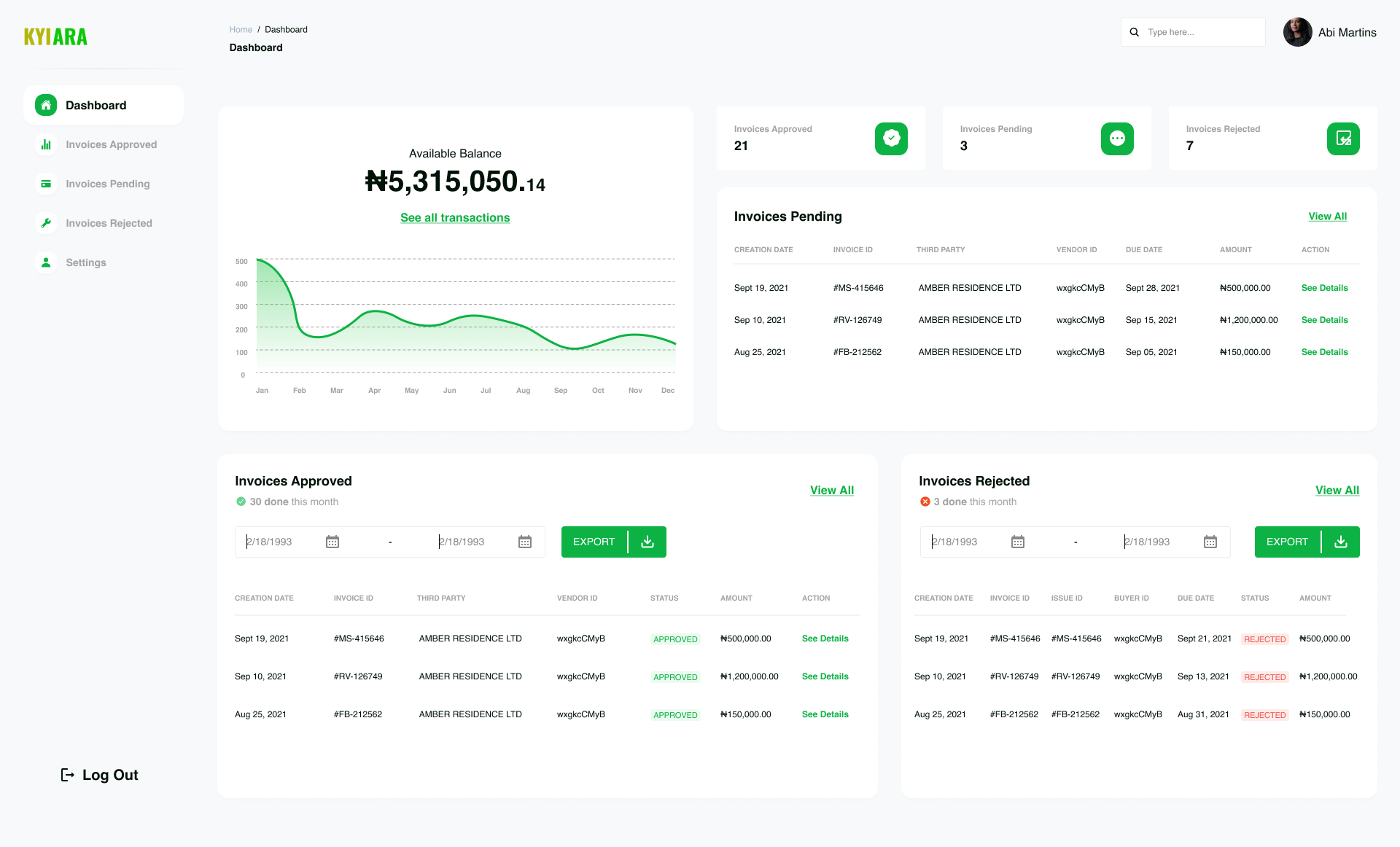

To allow vendors to upload unpaid invoices and get finance offers for them quickly upon confirmation from Buyers.

To provide financiers with a secure, authentic and ready marketplace for their factoring needs.

To provision merchant accounts for all users in order to move funds within and outside the platform.

To enable regulators to have more visibility over the entire ecosystem.

To provide a platform that allows for the seamless payment of invoices to vendors.